India & Global Inflation: What You Need to Know

The Ripple Effect: How Global Inflation is Affecting India

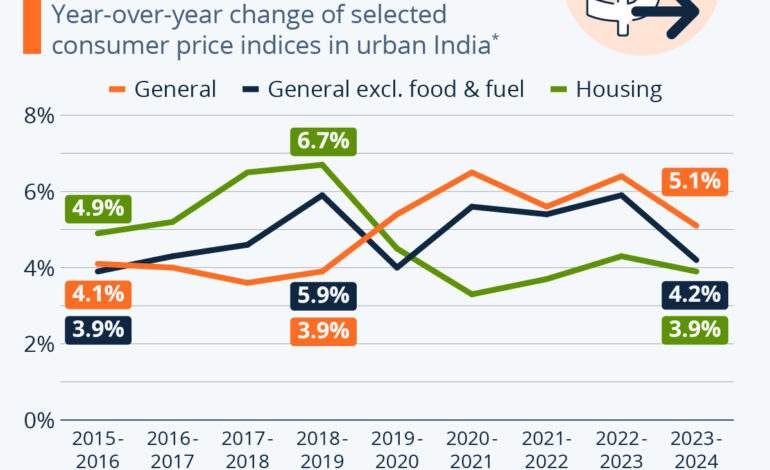

Inflation. It’s a word we’re hearing a lot these days, and for good reason. While often discussed in abstract economic terms, inflation has a very real and tangible impact on the lives of everyday people. And it’s not just a domestic issue; global inflationary pressures are significantly impacting India, creating a complex economic landscape. This post will delve into the intricacies of how global inflation is affecting India, exploring the key drivers, the sectors most impacted, and what measures are being taken to mitigate the effects.

Understanding the Global Inflationary Landscape

Before we focus on India, it’s crucial to understand the root causes of the global inflation surge. Several factors are at play. The initial shock came with the COVID-19 pandemic. Lockdowns and disruptions to supply chains created bottlenecks, limiting the availability of goods. Simultaneously, demand remained relatively strong, fueled by government stimulus packages in many countries. This classic supply-demand imbalance pushed prices upwards.

However, the situation was then compounded by the war in Ukraine. Russia and Ukraine are major exporters of key commodities like energy (oil and gas), food grains (wheat, corn, sunflower oil), and fertilizers. The conflict disrupted these supply chains dramatically, leading to sharp price increases. Energy prices, in particular, have been a major driver of global inflation, as they impact transportation costs and the production of many other goods.

Furthermore, many developed nations pursued expansionary monetary policies – keeping interest rates low and injecting liquidity into the financial system – to support their economies during the pandemic. While intended to stimulate growth, this also contributed to increased money supply, further fueling inflationary pressures. Finally, a weaker Indian Rupee against the US Dollar exacerbates the problem, as India imports many commodities priced in dollars.

Impact on Key Sectors in India

So, how is this global inflation manifesting itself in India? The effects are widespread, but some sectors are feeling the pinch more acutely than others:

- Food & Agriculture: India is heavily reliant on imports for edible oils, and the war in Ukraine has significantly disrupted sunflower oil supplies. Wheat prices also rose sharply, although India has stepped up its own wheat exports to some extent. Fertilizer prices have soared, increasing the cost of agricultural production and potentially impacting future harvests. This directly translates to higher food prices for consumers.

- Energy: India imports over 80% of its crude oil requirements. The surge in global oil prices has led to increased petrol and diesel prices, impacting transportation costs, manufacturing, and ultimately, the prices of most goods and services. Higher fuel prices also contribute to overall inflation, creating a vicious cycle.

- Manufacturing: The manufacturing sector is facing increased input costs due to higher raw material prices (metals, chemicals, etc.) and energy costs. This is squeezing profit margins and forcing manufacturers to pass on these costs to consumers. Global supply chain disruptions continue to hamper production and delivery schedules.

- Transportation & Logistics: Higher fuel prices directly impact the transportation sector, increasing freight charges and the cost of moving goods across the country. This adds to the overall cost of logistics and contributes to inflation.

- Consumer Durables: The cost of producing consumer durables (electronics, appliances, etc.) has increased due to higher component prices and transportation costs. This is making these items less affordable for consumers.

The Indian Government and the Reserve Bank of India’s Response

The Indian government and the Reserve Bank of India (RBI) are taking several steps to address the inflationary pressures. The RBI has been actively tightening monetary policy, raising the repo rate (the rate at which it lends to commercial banks) several times in recent months. This aims to curb demand and cool down the economy. However, raising interest rates can also slow down economic growth.

The government has implemented measures to reduce import duties on certain essential commodities, such as edible oils, to lower their prices. It has also been focusing on boosting domestic production of key commodities to reduce reliance on imports. Efforts are being made to diversify supply chains and explore alternative sources for critical raw materials.

Furthermore, the government is closely monitoring the situation and taking steps to ensure adequate supply of essential commodities. Export restrictions on certain items have been imposed to ensure domestic availability. Subsidies and other support measures are being provided to vulnerable sections of the population to cushion the impact of rising prices.

Looking Ahead: Challenges and Opportunities

The outlook for inflation in India remains uncertain. Global factors, such as the ongoing war in Ukraine and the trajectory of energy prices, will continue to play a significant role. The pace of economic recovery in major economies will also influence global demand and prices.

However, India also has some inherent strengths that can help it navigate these challenges. A relatively strong domestic demand, a growing middle class, and a resilient agricultural sector provide a buffer against external shocks. Investments in infrastructure and manufacturing can help boost domestic production and reduce reliance on imports in the long run.

The current inflationary environment presents both challenges and opportunities for India. While rising prices are undoubtedly a concern, they also incentivize businesses to innovate, improve efficiency, and explore new markets. The government and the RBI need to strike a delicate balance between controlling inflation and supporting economic growth. A coordinated and proactive approach will be crucial to mitigating the impact of global inflation and ensuring a stable and sustainable economic future for India.

Ultimately, navigating this period of global economic uncertainty requires careful planning, strategic policy interventions, and a commitment to long-term economic resilience.