Election Results: What Global Markets Are Doing Now

The Ripple Effect: How Election Results Impact Global Markets

Elections are cornerstones of democratic societies, but their influence extends far beyond the ballot box. They are pivotal moments that can send shockwaves through global markets, impacting everything from stock prices and currency values to investment strategies and economic forecasts. Understanding this connection is crucial for investors, businesses, and anyone interested in the health of the global economy. This post will delve into the multifaceted ways election results can – and often do – influence the financial world.

The Immediate Reaction: Initial Market Sentiment

The first reaction to an election result is often the most dramatic. Markets dislike uncertainty, and the period leading up to an election is rife with it. Once a winner is declared (or a clear outcome emerges), markets react almost instantaneously. This initial reaction is largely driven by sentiment – how investors *feel* about the outcome.

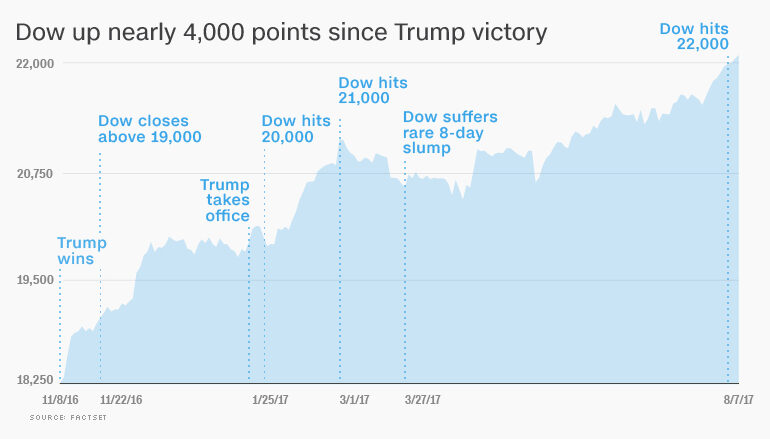

If the result aligns with market expectations, you might see a positive reaction. For example, if a pro-business candidate with a clear economic plan wins, stock markets are likely to rally. Conversely, an unexpected victory by a candidate perceived as anti-business or advocating for radical economic changes can trigger a sell-off. We’ve seen this play out repeatedly throughout history. Think back to the surprise Brexit vote in 2016, or the unexpected election of Donald Trump in the same year – both events caused significant market volatility.

It’s important to remember that this initial reaction isn’t always rational. It’s often based on knee-jerk reactions and interpretations of what the result *means* rather than a detailed analysis of the actual policies that will be implemented. This is where the potential for both opportunity and risk lies.

Policy Implications: The Long-Term Drivers

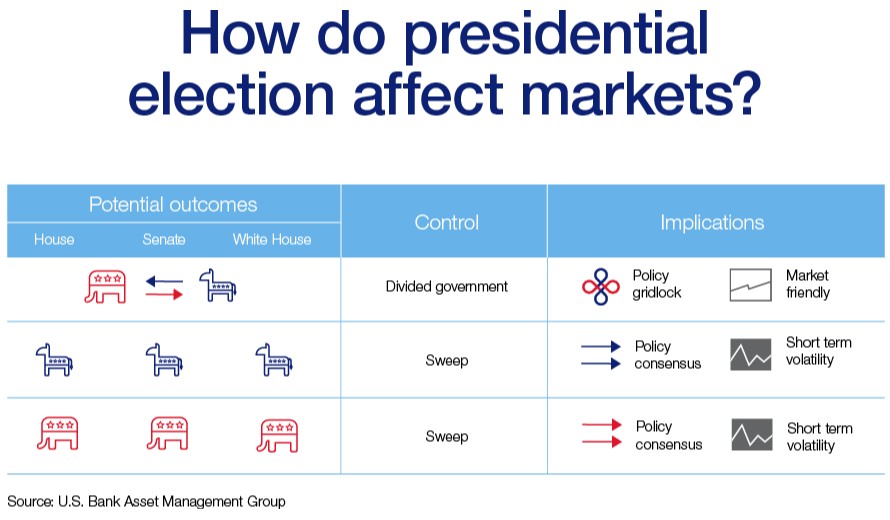

While initial sentiment sets the tone, the long-term impact of an election result is determined by the policies the winning party (or coalition) actually pursues. These policies can affect markets in numerous ways:

- Fiscal Policy: Changes to taxation, government spending, and debt levels have a direct impact on economic growth and corporate profits. Lower taxes can boost corporate earnings, while increased government spending can stimulate demand. However, higher debt levels can raise concerns about long-term sustainability.

- Monetary Policy: While central banks are typically independent, election results can influence monetary policy indirectly. A new government might appoint different central bank governors or advocate for changes to the central bank’s mandate.

- Trade Policy: Elections can lead to shifts in trade policy, such as the imposition of tariffs, the negotiation of new trade agreements, or a retreat from globalization. These changes can significantly impact businesses involved in international trade.

- Regulatory Policy: Changes to regulations affecting industries like finance, healthcare, and energy can have a profound impact on corporate behavior and investment decisions.

- Geopolitical Stability: Election results can also affect geopolitical stability, which in turn impacts markets. A change in government can lead to shifts in foreign policy, potentially increasing or decreasing tensions with other countries.

For example, a government focused on renewable energy might incentivize investment in that sector, while a government prioritizing fossil fuels might offer subsidies to oil and gas companies. These policy choices will have clear winners and losers in the market.

Sector-Specific Impacts: Who Benefits and Who Loses?

Not all sectors are affected equally by election results. Some industries are more sensitive to policy changes than others. Here’s a breakdown of how different sectors might react:

Healthcare: Elections often involve debates about healthcare reform. A government proposing universal healthcare might negatively impact private health insurance companies, while a government focused on deregulation could benefit them.

Financial Services: Regulations governing the financial industry are frequently debated during elections. Stricter regulations can increase compliance costs for banks, while deregulation could lead to increased risk-taking.

Energy: Energy policy is a major battleground in many elections. Policies promoting renewable energy can benefit companies in that sector, while policies supporting fossil fuels can benefit oil and gas companies.

Infrastructure: Governments often promise to invest in infrastructure projects. This can benefit construction companies, materials suppliers, and engineering firms.

Defense: Changes in foreign policy and defense spending can significantly impact defense contractors.

Currency Markets: A Reflection of Confidence

Currency markets are particularly sensitive to election results. A country’s currency value reflects investor confidence in its economy and political stability.

If an election result is perceived as positive for the economy, the currency is likely to strengthen. This is because investors will be more willing to invest in that country, increasing demand for its currency. Conversely, if an election result is perceived as negative, the currency is likely to weaken.

Exchange rate fluctuations can have a significant impact on businesses involved in international trade. A stronger currency makes exports more expensive and imports cheaper, while a weaker currency has the opposite effect.

Navigating the Volatility: Strategies for Investors

So, how should investors navigate the volatility that often accompanies election results? Here are a few strategies to consider:

Diversification: A well-diversified portfolio can help mitigate risk. Don’t put all your eggs in one basket.

Long-Term Perspective: Don’t make rash decisions based on short-term market fluctuations. Focus on your long-term investment goals.

Research: Thoroughly research the policies of the candidates and parties involved. Understand how those policies might impact your investments.

Consider Sector Rotation: Adjust your portfolio to favor sectors that are likely to benefit from the election outcome.

Stay Informed: Keep up-to-date on the latest developments and analysis from reputable sources.

Conclusion: Elections as Catalysts for Change

Election results are powerful catalysts for change in global markets. While the initial reaction can be driven by sentiment, the long-term impact is determined by the policies that are implemented. By understanding the complex interplay between elections, policy, and market dynamics, investors and businesses can better navigate the volatility and capitalize on the opportunities that arise. It’s a reminder that the political landscape is inextricably linked to the economic one, and paying attention to both is essential for success in today’s interconnected world.