India & Global Inflation: What You Need to Know

The Ripple Effect: How Global Inflation is Affecting India

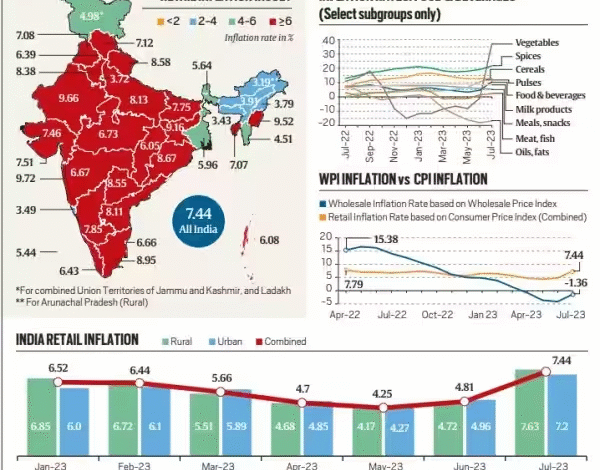

Inflation. It’s a word we’re hearing a lot these days, and for good reason. While often discussed in abstract economic terms, inflation has a very real and tangible impact on the lives of everyday people. And it’s not just a domestic issue; global inflationary pressures are significantly impacting India, creating a complex economic landscape. This post will delve into the intricacies of how global inflation is affecting India, exploring the key drivers, the sectors most impacted, and what measures are being taken to mitigate the effects.

Understanding the Global Inflationary Landscape

Before we focus on India, it’s crucial to understand the root causes of the global surge in inflation. Several factors are at play. The initial shock came with the COVID-19 pandemic. Lockdowns and disruptions to supply chains created bottlenecks, limiting the availability of goods. As economies began to recover, demand surged, but supply couldn’t keep pace, leading to price increases. This was further exacerbated by the war in Ukraine.

The conflict has had a profound impact on global commodity markets, particularly energy and food. Russia and Ukraine are major exporters of oil, natural gas, wheat, and fertilizers. The war disrupted these supplies, sending prices soaring. Energy prices, in particular, have been a major driver of inflation worldwide, as they impact transportation costs and the production of many goods. Furthermore, increased government spending during the pandemic, aimed at supporting economies, injected significant liquidity into the system, contributing to demand-pull inflation.

How Global Inflation Translates to India

India, as a major importing nation, is particularly vulnerable to global inflationary pressures. Here’s how the global situation is manifesting itself within the Indian economy:

- Import Costs: A significant portion of India’s energy needs are met through imports. Rising global oil and gas prices directly translate to higher import bills, impacting the trade deficit and contributing to domestic inflation. Similarly, India imports key raw materials and intermediate goods, the prices of which have increased due to global supply chain disruptions.

- Rupee Depreciation: Global inflation and rising interest rates in the US have led to a strengthening of the US dollar. This, in turn, has put downward pressure on the Indian Rupee. A weaker Rupee makes imports even more expensive, further fueling inflation. The depreciation of the Rupee is a critical factor amplifying the effects of global inflation.

- Commodity Prices: India is a major consumer of commodities like edible oils, metals, and fertilizers. Global price increases in these commodities directly impact domestic prices, affecting both consumers and industries.

- Portfolio Flows: Higher interest rates in developed economies attract capital away from emerging markets like India. This outflow of capital can put further pressure on the Rupee and limit the availability of funds for investment.

Sectors Most Affected in India

While inflation impacts almost all sectors, some have been particularly hard hit:

Food & Beverages: Edible oil prices have seen substantial increases due to the war in Ukraine and supply chain issues. Wheat and other grain prices have also risen, impacting the cost of essential food items. This directly affects household budgets, especially for lower-income families. Food inflation is a major concern in India, given its significant impact on the population.

Transportation: Rising fuel prices have led to higher transportation costs, impacting the prices of goods and services across the board. This affects everything from logistics and supply chains to public transportation fares.

Manufacturing: Manufacturers rely on imported raw materials and energy. Higher input costs are forcing them to either absorb the costs (reducing profits) or pass them on to consumers (increasing prices). This can lead to reduced production and slower economic growth.

Automobile Industry: The automobile industry has been facing challenges due to rising commodity prices (steel, aluminum, semiconductors) and supply chain disruptions. This has led to increased vehicle prices and reduced demand.

Government and RBI Measures to Combat Inflation

The Indian government and the Reserve Bank of India (RBI) are taking several steps to address the inflationary pressures:

RBI Monetary Policy: The RBI has been actively tightening monetary policy by raising the repo rate (the rate at which it lends to commercial banks). This aims to curb demand and reduce liquidity in the system. The RBI’s focus is on controlling inflation while supporting economic growth.

Fiscal Measures: The government has reduced excise duty on petrol and diesel to provide some relief to consumers. It has also taken steps to boost domestic production of certain commodities to reduce reliance on imports.

Supply Chain Management: Efforts are being made to improve supply chain efficiency and reduce bottlenecks. This includes investing in infrastructure and streamlining logistics.

Import Diversification: India is actively seeking to diversify its import sources to reduce its dependence on any single country or region.

Managing Rupee Volatility: The RBI has intervened in the foreign exchange market to manage the volatility of the Rupee and prevent excessive depreciation.

Looking Ahead: Challenges and Opportunities

The outlook for inflation in India remains uncertain. Global factors, such as the duration of the war in Ukraine and the trajectory of energy prices, will continue to play a significant role. Domestically, the monsoon season will be crucial, as a good monsoon can boost agricultural production and help to moderate food prices.

However, amidst the challenges, there are also opportunities. The current situation could incentivize India to accelerate its efforts towards self-reliance (Atmanirbhar Bharat) by boosting domestic manufacturing and reducing import dependence. Investing in renewable energy sources can also help to reduce India’s vulnerability to volatile global energy markets. Ultimately, navigating this period of global inflation will require a combination of prudent monetary and fiscal policies, as well as a long-term focus on building a more resilient and self-sufficient economy.

It’s a complex situation, and staying informed is key. Monitoring global developments and understanding their impact on the Indian economy will be crucial for businesses, policymakers, and individuals alike.