2025 Budget: Surprising Trends You Need to Know

Unexpected Trends from the 2025 Union Budget

The 2025 Union Budget has been unveiled, and while many predicted a continuation of existing economic policies, several unexpected trends have emerged. This budget isn’t just about numbers; it signals a potential shift in the government’s priorities and a fascinating glimpse into the future of the Indian economy. Let’s dive deep into the key surprises and what they mean for citizens, businesses, and the overall economic landscape.

A Surprising Focus on Rural Infrastructure

Perhaps the most significant deviation from expectations is the substantial increase in allocation towards rural infrastructure. While previous budgets have emphasized urban development and digital connectivity, the 2025 budget dedicates a remarkable 22% of the total capital expenditure to projects focused on improving rural roads, irrigation systems, and agricultural storage facilities. This is a considerable jump from the 15% allocated in the previous fiscal year.

Why is this unexpected? Many analysts believed the government would continue prioritizing urban centers, given the ongoing migration trends and the perceived economic benefits of concentrated development. However, this budget suggests a renewed focus on bolstering the rural economy, potentially aiming to curb migration, create local employment opportunities, and enhance agricultural productivity. The budget documents specifically mention a new “Rural Resilience Fund” designed to provide financial assistance to states for implementing innovative agricultural practices and improving rural supply chains. This fund alone accounts for a significant portion of the increased rural allocation.

The Green Hydrogen Push – Beyond Expectations

The commitment to Green Hydrogen production has been consistently present in recent policy statements, but the 2025 budget takes it to a whole new level. The government has announced a massive subsidy program for companies involved in the production of Green Hydrogen and its derivatives (like Green Ammonia). This isn’t just a small incentive; it’s a comprehensive package including production-linked incentives (PLI), tax breaks, and dedicated research and development funding.

What’s surprising is the scale of the investment. The budget allocates ₹50,000 crore (approximately $6 billion USD) over the next five years specifically for Green Hydrogen initiatives. This demonstrates a clear intention to position India as a global leader in this emerging energy sector. Furthermore, the budget proposes mandating the use of Green Hydrogen in certain industrial processes, creating a guaranteed demand for the product and encouraging private sector participation. This proactive approach is a departure from the more cautious, incentive-based strategies typically employed.

A Shift in Taxation – Focus on Consumption

While there were no major changes to income tax slabs, the budget introduces some interesting adjustments to consumption taxes. Specifically, there’s a reduction in GST rates on certain consumer durables, particularly those related to energy efficiency and sustainable living – think electric vehicles, solar panels, and energy-efficient appliances. Simultaneously, there’s a slight increase in GST on luxury goods and services.

This signals a subtle but significant shift in the government’s taxation philosophy. It appears to be incentivizing responsible consumption and promoting environmentally friendly choices. The reduction in GST on essential consumer durables could also provide a boost to domestic manufacturing and stimulate demand. The increase on luxury items, while relatively small, suggests a willingness to address wealth inequality and generate revenue from higher-income segments.

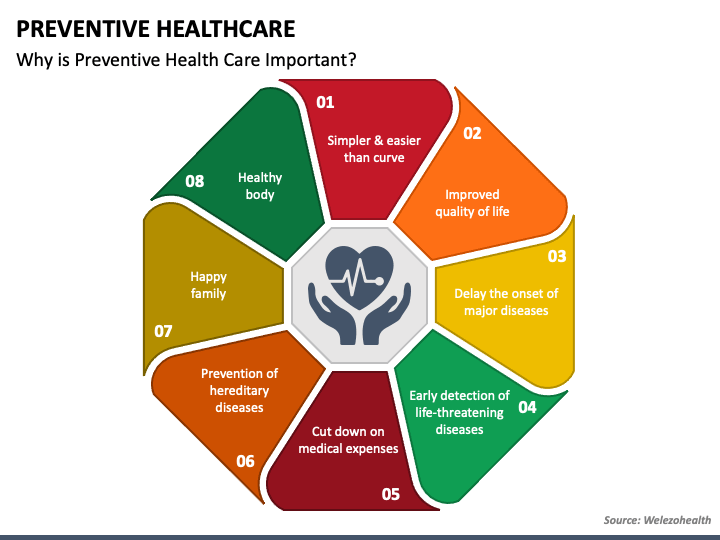

Healthcare – Preventative Care Takes Center Stage

The healthcare sector received a modest increase in overall allocation, but the real surprise lies in the re-prioritization of funds towards preventative healthcare. Traditionally, a large portion of the healthcare budget has been allocated to hospital infrastructure and treatment of illnesses. The 2025 budget, however, significantly increases funding for public health campaigns, wellness centers, and early detection programs.

This is a welcome change, as preventative care is often more cost-effective and leads to better health outcomes in the long run. The budget outlines plans to establish “Wellness Hubs” in every district, offering free health check-ups, counseling, and access to information on healthy lifestyles. There’s also a strong emphasis on leveraging technology – including telemedicine and AI-powered diagnostic tools – to improve access to healthcare in remote areas. This focus on proactive health management is a positive sign for the future of public health in India.

Fintech Regulation – A Balanced Approach

The rapid growth of the Fintech sector has presented both opportunities and challenges for regulators. The 2025 budget attempts to strike a balance between fostering innovation and ensuring financial stability. Instead of imposing overly restrictive regulations, the government has announced the creation of a “Regulatory Sandbox” specifically for Fintech companies.

This sandbox will allow Fintech firms to test new products and services in a controlled environment, without being subject to the full weight of existing regulations. The goal is to encourage experimentation and innovation while mitigating potential risks. The budget also proposes a simplified KYC (Know Your Customer) process for low-value transactions, making it easier for individuals to access Fintech services. This approach demonstrates a pragmatic understanding of the Fintech landscape and a willingness to adapt regulations to accommodate emerging technologies.

What Does This All Mean?

The 2025 Union Budget is a complex document with far-reaching implications. The unexpected trends highlighted above suggest a government that is willing to challenge conventional wisdom and prioritize long-term sustainability over short-term gains. The focus on rural infrastructure, Green Hydrogen, preventative healthcare, and a balanced approach to Fintech regulation all point towards a vision of a more inclusive, resilient, and environmentally conscious India.

However, the success of these initiatives will depend on effective implementation and close collaboration between the government, private sector, and civil society. It remains to be seen whether these ambitious plans will translate into tangible benefits for all citizens, but the 2025 budget certainly offers a reason for cautious optimism.